A look at some time series evidence and conclusions for IOER and NGDP

However, some detractors argue that, because of interest on excess reserves, policies such as quantitative easing are useless. Because banks can just hoard the money and get interest payments from the Fed, QE doesn't spur any additional lending. Others argue that QE just takes collateral out from the financial system, thereby shortening collateral chains and contracting the economy.

So what does the data say?

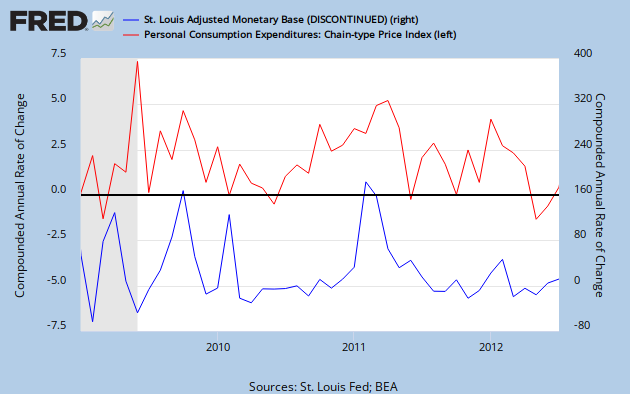

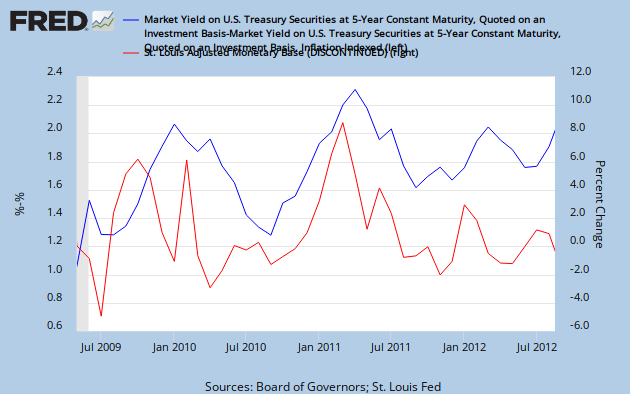

Not surprisingly, expansions of the monetary base, even at the zero lower bound, have a powerful effect on both current inflation and expectations of future inflation. The graphs below are changes in inflation and inflation expectations with respect to changes in the monetary base.

The first two growth spurts of the monetary base in the two graphs are QE I, QE II, respectively. The fact that inflation moved with the monetary base is important. In the time periods for both graphs, IOER was at 0.25% and the fed funds rate was at 0-0.25%. However, this did not nullify the effects of a monetary base expansion on inflation or the expectations thereof.

Therefore, these graphs provide a tentative answer to the debate over negative rates, nominal GDP targeting, QE, IOER, and collateralization. First, expanding the monetary base boosts inflation and nominal GDP. This happens in spite of the removal of safe collateral from the repo market. Additionally, IOER has not proven to be a barrier to QE or other expansions of the monetary base. Under such conditions, why not maintain IOER? Money market funds can reap the benefits of a guaranteed income stream AND higher nominal GDP growth. The debate on negative rates and IOER becomes a moot point. Given IOER is not a barrier to monetary expansion, the Fed can leave it untouched and pursue a transition to a nominal GDP target in different ways.

As a result, I stand by my original policy suggestion of continued interest rate guidance combined with more QE while leaving IOER untouched. Quantitative easing fundamentally changes what forward guidance means. Because low interest rates are not reliable indicators of monetary policy, a policy that only commits to a long period of low interest rates may be perceived as a Delphian prediction that nominal GDP growth will be slow. On the other hand, if QE provides the pressure for rising inflation and nominal GDP growth, forward guidance turns into an Odyssean commitment to low interest rates in spite of higher nominal GDP growth. With IOER still around to guard against any uncertain effects of negative rates, this policy would maintain financial stability while guarantee robust nominal GDP growth.

“Money market funds can reap the benefits of a guaranteed income stream”: what’s so great about that (as a policy objective; I realize the operators of money market funds would like it)? Eliminate IOR and there would be much less quantitative easing that you’d have to do.

ReplyDelete