Consider the following news article:

WASHINGTON (AP) — Higher gas prices are crimping consumer spending and slowing the already-weak U.S. economy. And they could get worse in the coming months.

The Federal Reserve this week took steps to boost economic growth. But those stimulus measures are also pushing oil prices up. If gas prices follow, consumers will have less money to spend elsewhere.

The impact of the Fed's actions "is likely to weigh on the value of the U.S. dollar and lift commodity prices," said Joseph Carson, U.S. economist at AllianceBernstein. "We would not be surprised if (it) fueled more inflation in coming months, squeezing the real income of U.S. workers."Given that the argument is that more spending on fuel causes less spending on other goods, purchases of durable goods should go down in response to an oil price spike. However, a quick look at the time series suggests otherwise.

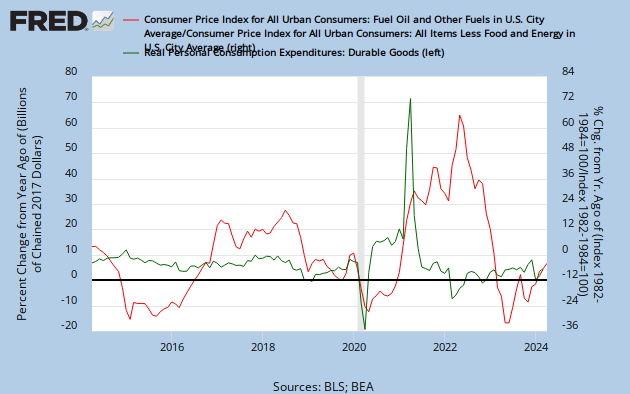

As noted by Ritwik, we need to look at durable goods spending in contrast to the amount fuel inflation exceeded regular inflation. So in the graph, blue is the real level of PCE on durable goods, while red is the fuel/oil component of the CPI divided by the part of the CPI less food and energy. From this we do see that although there are some times where oil prices go in the opposite direction of real purchases of durable goods, in general they move together. We can get a more precise image of this by looking at year over year growth rates:

As well as a running correlation of the two graphs. The correlation at any given time looks at the 12 months before the given month including the given month as well as the twelve months after. The thick lines are the thresholds for statistical significance.

This suggests that while rising oil prices sometimes hurt the economy, such as in early 2004 or early 2008, rising oil prices can also be a sign of a recovery, such as in 2009 and 2010.

The mistake the news article makes is that it starts from the price change in oil and then tries to figure out what happens to demand in other goods. Instead, one should proceed from demand and derive the change in price. If the factor pushing up fuel prices is a general increase in income and aggregate demand, that means the gas price rise is a part of a general rise in the price level, meaning purchases of other goods actually increases with the rise in gas prices. However, if the reason gas prices rise is because oil refineries in the Middle East are shut down, crimping aggregate supply, then the rise in the relative gas price would reduce demand for other goods, lowering the overall standard of living in the economy.

This kind of analysis is also powerful in microeconomics when answering the classic question of "what happens to consumer expenditure on other goods if the price of gas rises?" To give a full answer, we have to know what causes the price increase. If the reason gas prices rise is because supply contracts and lowers the equilibrium quantity transacted, then people will buy fewer other consumer goods. But if the reason gas prices rise is because higher incomes push up demand, then we should expect people to buy more consumer goods.

In Econ 101, one could possibly get around the problem by pointing out that a rise in income would cause a general rise in the price level, not the relative rise that is important in microeconomics. However, this does not mean we can reason from a price change in microeconomics.

First, sticky prices for durable goods means that a rise in income will directly increase the relative price of fuel, but this change will still predict an increase in durable goods purchases.

Second, a change in preferences towards something that requires large amounts of gas, such as roadtrips, would increase the relative value of gas while also increasing demand for restaurant food and hotel rooms.

The problem is that price changes are not exogenous; they happen as the result of changes in supply and demand. Outside of corner cases*, there is no such thing as "ceteris paribus, the gas becomes relatively more expensive." Quantity changes always accompany price changes, and supply and demand determine the two. In the case of monetary policy, we should look towards the recent rise in commodity prices with approval, as it is a sign that policy is working by increasing demand and stabilizing nominal GDP.

Yichuan

ReplyDeleteLet's add another rule. Never reason from an incomplete graph.

To the left of the recession, what does the graph show? Inflation is non-zero and growth is non-zero. That proves nothing about the impact of commodity inflation on substitution.

During the recession, if one was to confuse the macroeconomic world as amenable to uni-variate analysis, it would seem as if the oil price spike caused the recession. To the right, we again have a regime of non-zero inflation and non-zero growth.

To get any intuition right, at the very least plot commodity inflation vs. general inflation? And change in durables growth rather than durables growth itself?

You need a difference-in-difference inference here. Graphing with levels unhelpful.

Ritwik,

ReplyDeleteYou make a good point on a difference-in-difference problem. I've amended the graphs and tried to give a more holistic view. What are your thoughts with the new state of the post?