Surprise, surprise, normal distributions don't describe life very well! This hardly seems like a controversial claim, but it's nice to see that the argument is being brought to such a non-technical outlet like NPR.

One of my personal favorite arguments against the bell curve is the fact that it's very sensitive to small miscalibrations in standard deviation, especially when we start to talk about 4, 5 sigma events. Goldman Sachs is even skilled enough to manage a 25-sigma several days in a row. Comically:

According to Goldman’s mathematical models, August, Year of Our Lord 2007, was a very special month. Things were happening that were only supposed to happen once in every 100,000 years. Either that … or Goldman’s models were wrong (Bonner, 2007b).

In excel, I compared the probability of an event with a z-score of less than -10, and then compared it to the probability of an event with a z scores 1% above and below that. If the z-score was actually 1% less than that, then the original probability was an overestimate. If the z-score was actually 1% higher, the original probability would have been an underestimate. I calculated the under and overestimate ratios for a range of errors, going from 0% to 10%. If the original probability calculation was an overestimate, the ratio was greater than 1. If the original probability calculation was an underestimate, the ratio was less than 1. The results were predictably monstruous:

The average ratio gives you an idea of how bad the probability estimation would be if you invested half of your portfolio in an investment for which you overestimated the probability, and the other half in one that underestimated the probability. This illustrates how ludicrous attempts to measure these small risks are. Even a "reasonably small" 5% uncertainty in the standard deviation can lead to an underestimation by a factor of about 55.

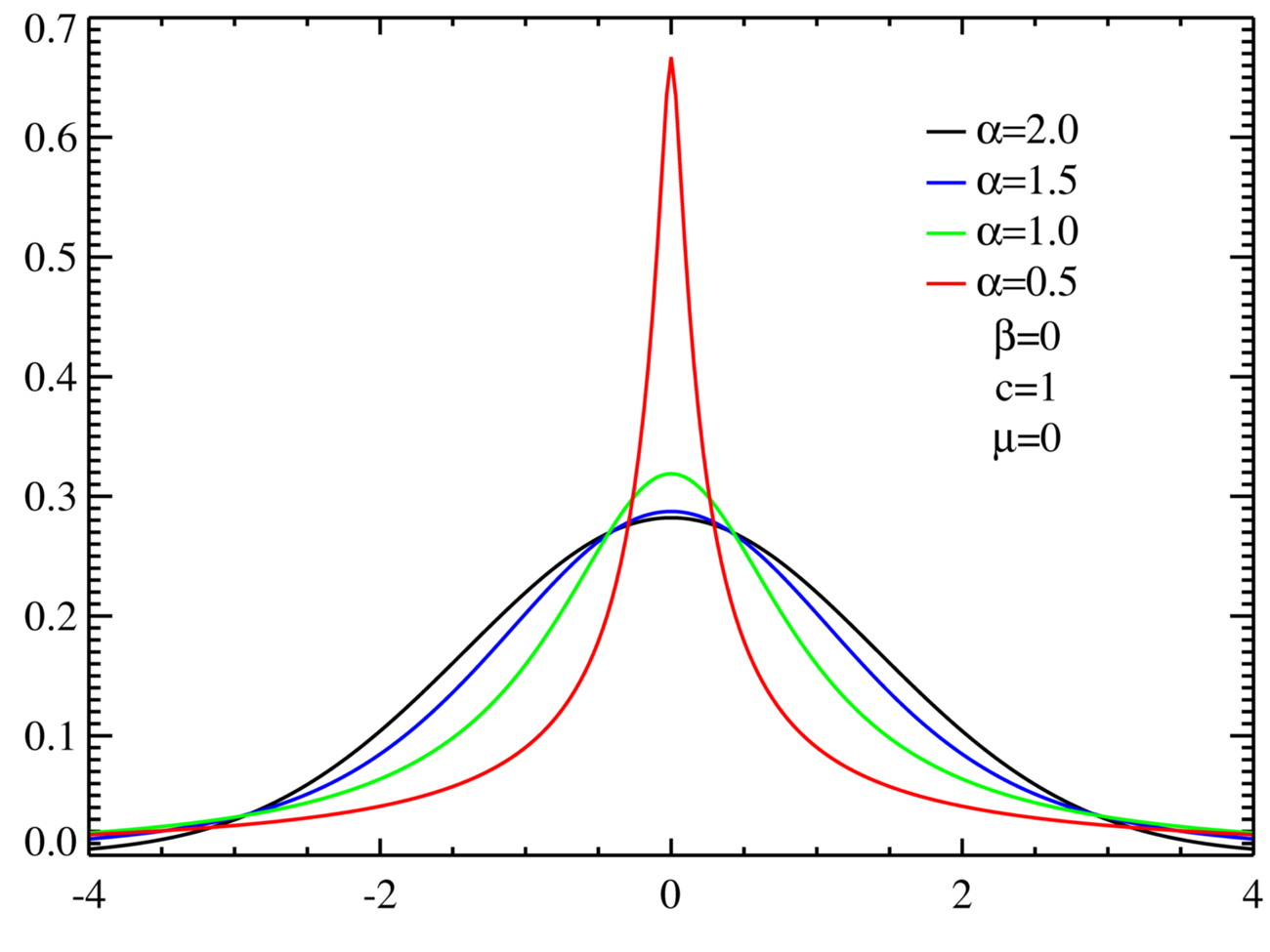

Taleb uses this as an apriori mathematical reason to reject the bell curve. If a standard deviation measurement has gaussian uncertainty, and if that uncertainty has gaussian uncertainty, when they compound they turn into power law volatility (Go down to "Errors, robustness, and the fourth quadrant")

The world is volatile. Therefore, we need to build our models and the world they shape to grow, not suffer, from volatility.

No comments:

Post a Comment